We have been asked the question (more than once) so wanted to address :

Are we seeing a shift in the market?

The Seattle Real Estate Market been on the rise for several years and has averaged just under 1-month inventory over the past 9 years. Just this summer, we have seen a drastically different market. A market of increased listings, creating less demand. First hand, we have seen listings remain on the market, past the review date, with 1 offer. Plus, more inventory than ever to show homebuyers. A great thing for home buyers. We are seeing fewer bidding wars, and escalations not going as high.

With increased inventory, buyers now have more home buying options than they have seen in the past 5 years.

Let’s discuss the facts:

-

Median single-family home in the region cost 13.6 percent more in May than a year prior, according to the monthly Case-Shiller home price index.

-

At month end, Northwest MLS reported 15,234 active listings and 1.5 months of supply. Inventory of single family homes and condos reached its highest level since October. The supply of active listings in King County surged 47 percent from a year ago, boosting the months of supply to just under 1.3 months — the highest level since September 2016 when there was 1.37 months of supply.

-

Existing-home sales dropped in June for a third straight month. Purchases of new homes are at their slowest pace in eight months. (national statistic)

-

Inventory, which plunged for years, has begun to grow again as buyers move to the sidelines, sapping the fuel for surging home values.

-

Prices for existing homes climbed 6.4 percent in May, the smallest year-over-year gain since early 2017, and have gained the least over three months since 2012, according to the Federal Housing Finance Agency. (national statistic)

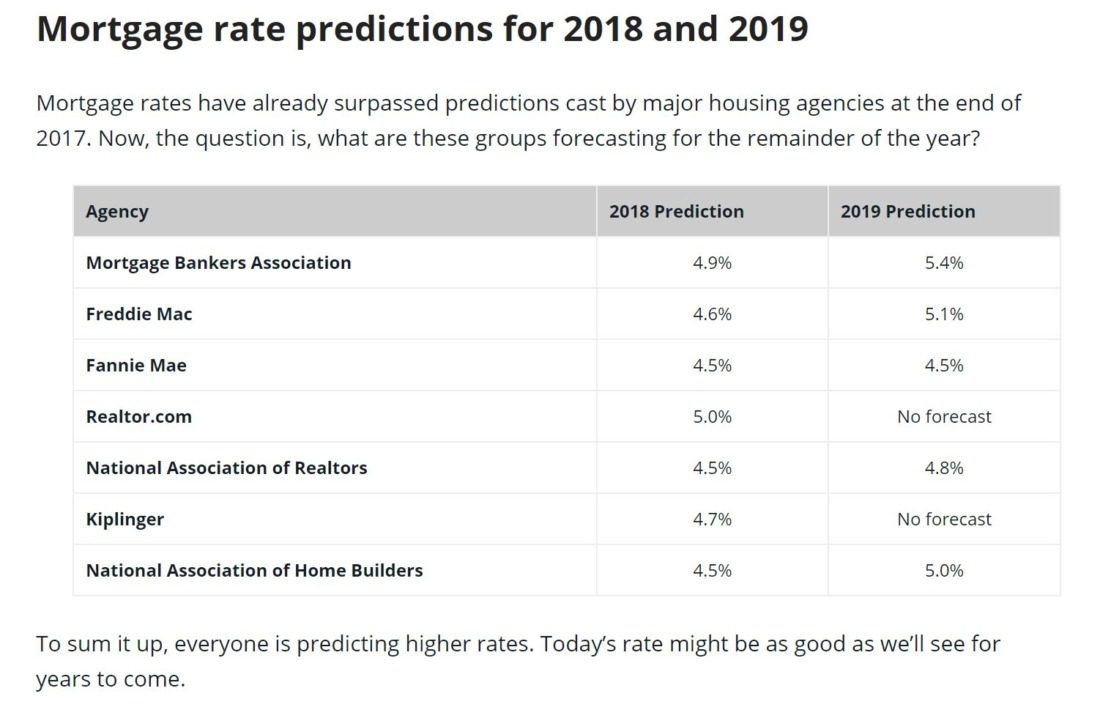

Another noteworthy topic which is drastically affecting a homebuyers purchasing power is:

Interest Rates.

The Fed passed on raising interest rates while mortgage rates rose across the board. The benchmark 30-year fixed-rate inched up to 4.75 percent from 4.71 percent last week, according to Bankrate’s weekly survey of large lenders. The 15-year fixed-rate rose to 4.20 percent, a five basis point gain from last week. Jumbo mortgages also saw a small climb. The 30-year fixed rate jumbo edged up to 4.68 percent from 4.66 percent last week.

Despite praise for a strong economy, Federal Reserve policymakers unanimously voted Wednesday to keep rates steady, remaining at a target between 1.75 and 2 percent. (Source: Bankrate publication 8/2/2018 here)

A “balanced” market is an inventory of 3-to-5 months of inventory. We are still below that.

Seattle is a unique city – we are an employment-driven city. Massive career and company growth. Seattle was just ranked as best big city to live in. Pro factors including employment, air quality, and walkability. Source

As long as we are creating 100,000-plus net new jobs annually in the Pacific Northwest and building fewer than 30,000 new single-family homes, these trends will continue,” suggested Mike Grady, the president and COO of Coldwell Banker Bain.

Moral of the story… Increased inventory creates less demand. Summer is always historically ‘slower’ then the Spring Real Estate market in Seattle. More than ever, it is a great time to purchase a home if you have been on the fence. You will likely save yourself tens of thousands of dollars due to not getting into a bidding war.

Leave A Comment