In our last blog post we shared about steps to take if buying a home is on your New Years Resolution List. Now – here are 3 tips to start now if you want to buy a home in 2017!

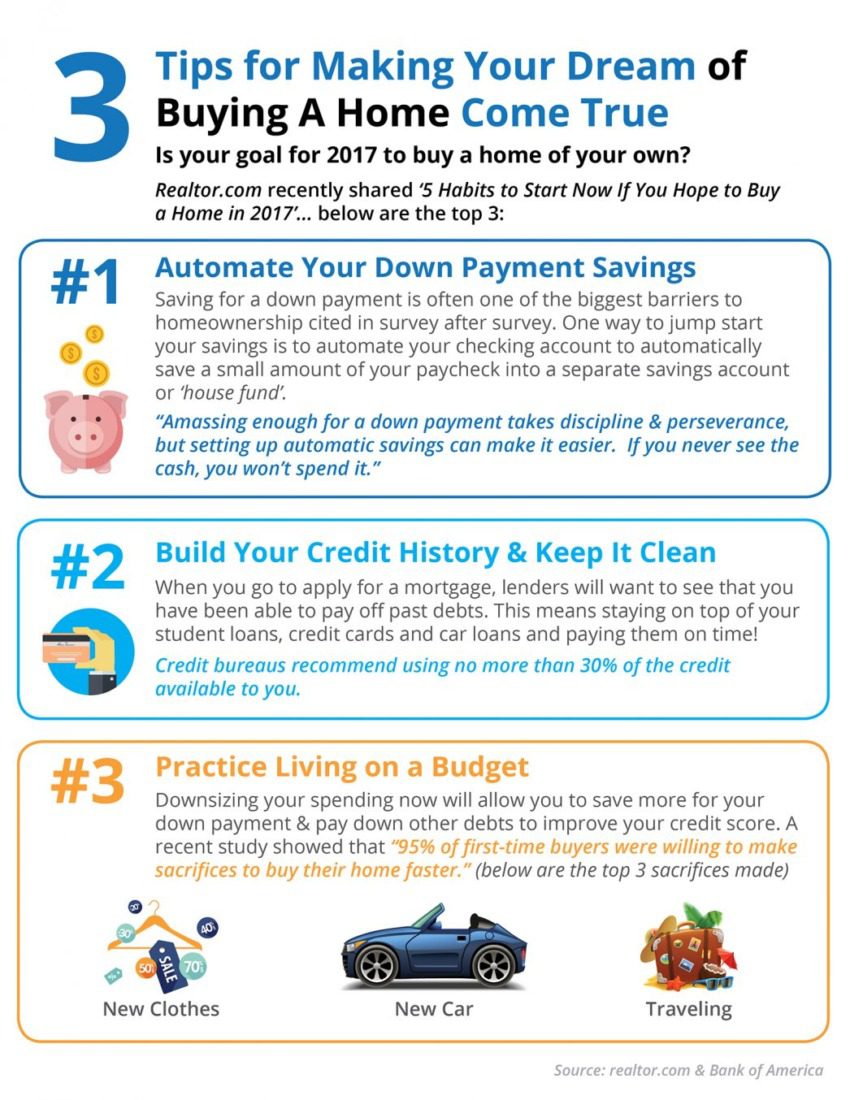

Habit No. 1: Automate your down payment savings

Saving for a home can take some time. Depending on what loan program you decide to go with, you may need anywhere from 0-20% down payment. For a typical Conventional mortgage payment, with no mortgage insurance, you would need 20%. On a $300,000 home, that would be $60,000. The best tip for success and making the savings a priority for your future home, is to start saving and automate your savings payments. (Even after you purchase the home, still automating a certain amount monthly into a separate ‘home account’ is a great idea) No, you are not bound to do 20% down – there are many other options. Read article here – on how to buy without 20% down.

Habit No. 2: Build your credit history and keep it clean

Credit Usage, Credit Score, and Past Credit Transactions play a big role in terms of qualifying for a future mortgage. When you get pre-approved, they pull your credit report so they can see your ‘ability to repay debt’. Keeping your usage below 30% is very very important – and the #1 thing to improve your credit score. Your income can be $250,000 but if your debts are extremely high, and you have never made a payment on time – this could significantly impact yourself in terms of buying a home.

Habit No. 3: Practice living on a budget

If you can – cut back on items that can help save for your future home. The picture above shows the 3 most common things Americans spend on. For me, eating out, can be eliminating to allocate towards saving quicker.

What can you cut out?

Ready to make your New Years Resolution happen?

We would love to help! Reach out to us today, and we would love to connect about your goals.

Leave A Comment